The allocation was well-spread globally with 65 of the principal amount of the 10-year Sukuk distributed to Asia 19 to Middle-East 11 to Europe and 5 to. A sukuk is an Islamic financial certificate similar to a bond in Western finance that complies with Sharia - Islamic religious law.

Malaysia Sukuk Market In A Glance Bix

Types of Sukuk Issued by Listed Firms in Main Market Figure 2 shows that six types of sukuk issued by listed firms.

. Rating Agency Investment advisors. Issuer name Name of the Sukuk Date of issuance Amount of issuance Tenure maturity Sukuk Rating. In return the investor will get a return on the funds he puts in based on a profit-sharing ratio.

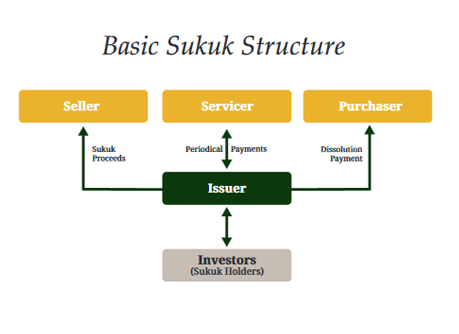

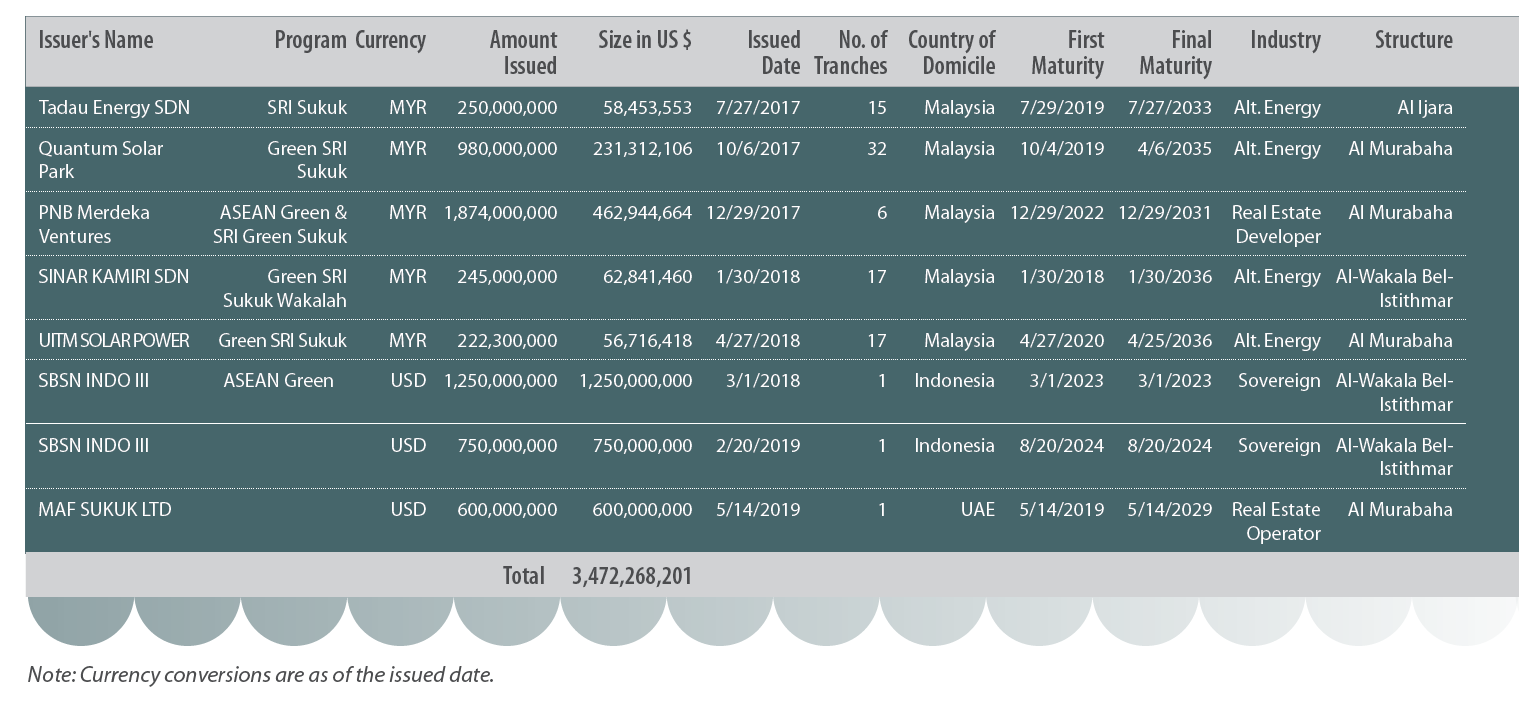

Other challenges of Green Sukuk include investors awareness demand for energy supply government support and demand for energy financing. When investors buy bonds or sukuk they become bondholders or sukuk holders. TYPES OF SUKUK The various types of sukuk can be divided into 4 basic types.

Regulations for Sukuk in Malaysia The Securities Commission SC supervises the Islamic capital market which operates parallel to the conventional capital market. A bond that is issued in compliance with Shariáh principles is known as Sukuk. Posted on November 2 2015.

Explain the differences between Asset-Based and Asset-Backed Sukuk. Most of the time interest payments are tax deductible. Types of Sukuk.

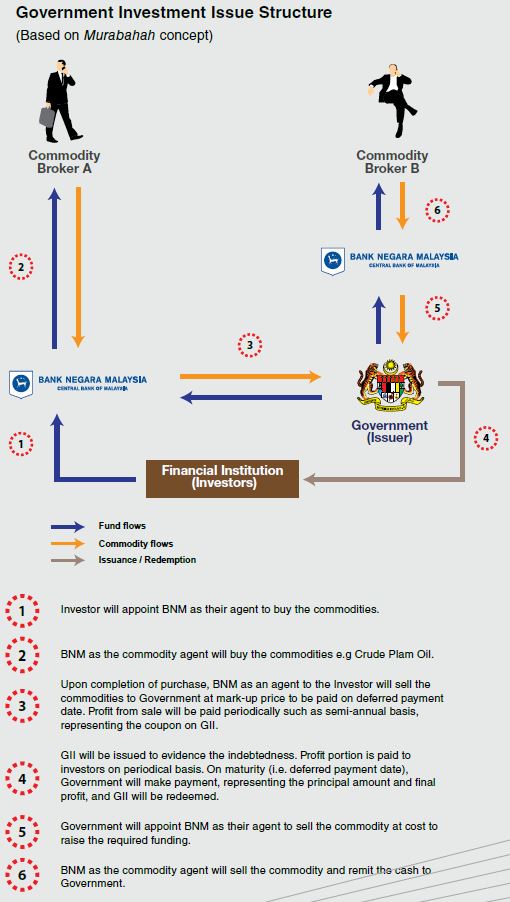

The main principle in a Sukuk mudharabah is that the investors are dormant business partners who do not participate in the management of the underlying. A bond is normally a long term debt securities offered by companies or governments the issuer to investors to meet their financing needs. In contrast most of the sukuk issued in Malaysia are murabaha-type sukuk primarily commodity murabaha sukuk.

Types of Sukuk Ijarah in Malaysia. Exchangeable and Convertible Sukuk. They are entitled to receive periodic coupon or a.

Discuss the legal and Shariah implications of the different types of Sukuk. Unfortunately I am not greatly involved in many Sukuk deals either by design or exposure. The SC originally issued the Guidelines on Sukuk which contained provisions specific to the nature and types of sukuk and their inherent practices.

The Climate Bond Initiative also gives guidance focusing on specific sectors. The types of sukuk that are issued in Malaysia currently are dominated by Murabahah typ e 66 in 2015 followed by Musyarakah 12 Wakalah 10 Ijarah 7. List two 2 examples of each type of Corporate Sukuk issued in Malaysia must be non-bank issued Corporate Sukuk.

Among the reasons why murabaha-type sukuk are widely used in Malaysia are that the scheme can also be used by issuers who do not own assets eligible for backing sukuk and because the simple structure keeps the cost of gaining approval as sharia compliant. Types of Sukuk Asset-Based Sukuk. At the same time as Islamic finance still fantastically new it appears as logical match for green bonds or in this case.

By the end of this programme participants will be able to. Some types of transactions are affected by additional duties. Asset-backed Sukuk provides a secure structure to the Sukuk holders where the true sale takes its.

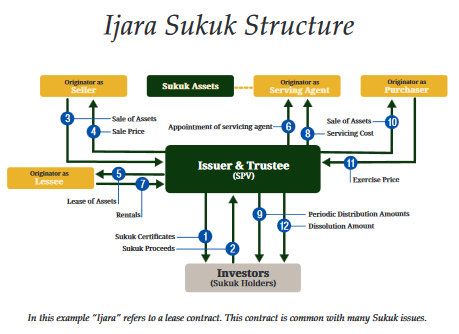

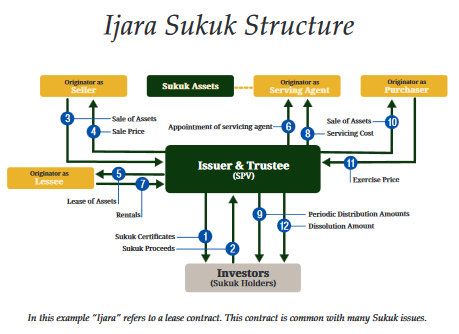

1 sales-based 2 lease- based 3 agent-based and 4 partneship-based. Development of Sukuk Ijarah in Malaysia 95 Abdulkader Thomas 2007. In addition the principle of Bay al-Dayn receives opposition from some of the scholars from the middle east Kamaruzaman et 2004.

How it works. In my line of work I get to see the legal documents but somewhat uninvolved when it comes to actual structuring. Asset-based Sukuk is debt-based structure where there are evidences of indebtedness between the.

Information on bonds and sukuks that you have invested in can be accessed through Bursa Malaysias website banks from which they were purchased media announcements that may be made from time to time and any other platform as may be designated by the SC. Argued that a new type of debt securities called sukuk certificates have grown to. Those indices cover the whole Sukuk and bond Malaysia n.

Sukuk al-Ijarah is the sukuk that usually attracts the interest of investors. The investor will supply the entrepreneur with funds for his business venture. For example Murabahah sukuk must pay.

As a bondholder or sukuk holder you should be proactive in monitoring your investment. Describe the Shariah and corporate governance issues in relations to the different types of Sukuk. One of the topics that I hardly write about are Sukuk islamic Bonds.

Among them are sukuk al-Ijarah sukuk of ownership of usufructs sukuk murabaha sukuk al. The list should include at least the following. This innovative Sukuk structure not only paves the way for other sovereigns to follow suit but also further affirms Malaysias position as the leader in international Islamic finance.

One hurdle when creating the necessary legal framework for sukuk in a countrys legislation is the differential treatment between profit and interest. On the other hand profit is taxable. But according to AAOIFI there are 14 eligible asset classes in its investment sukuk standards.

Sukuk Issuance By Type Of Issuer In Malaysia Usd Mil Download Scientific Diagram

Malaysia New Issuance Bonds And Sukuk 2020 Statista

The Global Islamic Finance Market Part 1 Sukuk Bonds Tmf Group

What Are Sukuk Azzad Asset Management Halal Investment

Malaysia Government Issues Myr 3 5 Billion Sukuk

Structure Of Ijarah Sukuk Issued By Tsh Co In Malaysia Download Scientific Diagram

Sukuk In Malaysian Capital Market Pdf Free Download

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

What Are Sukuk Azzad Asset Management Halal Investment

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

Sukuk Contracts In Malaysia Bix

Sukuk In Malaysian Capital Market Pdf Free Download

Sukuk Contracts In Malaysia Bix

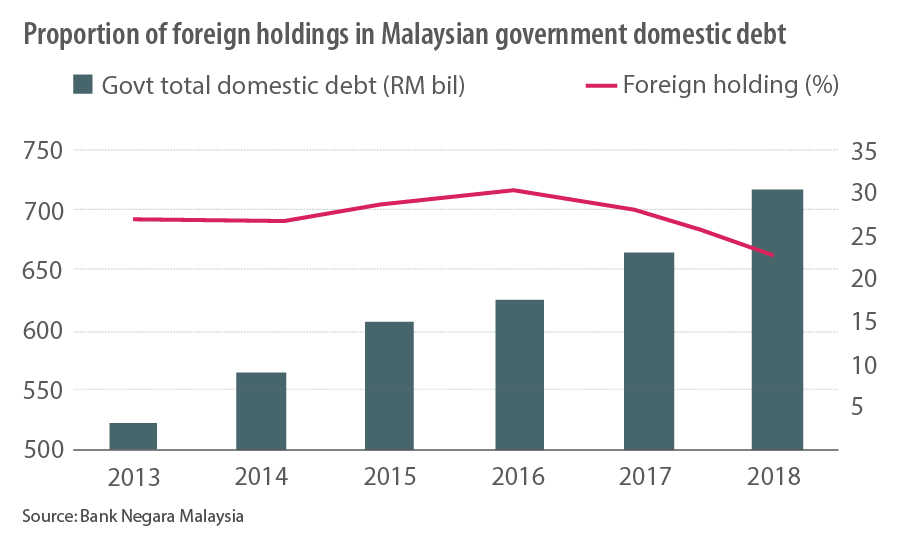

Malaysia Remains Biggest Global Sukuk Market

Sukuk Issuance By Type Of Issuer In Malaysia Usd Mil Download Scientific Diagram

Beginner S Guide To Bond And Sukuk Malaysia Free E Book Bix

First Sustainability Sukuk A Credit Positive For Malaysia The Star